Fixed Income

Core Plus

Philosophy

- We believe that opportunities to add alpha exist through a relative value approach and that utilizing a wide range of higher cash flow producing asset classes generally leads to return opportunities.

- Further, we believe that a rigorous, fundamental investment process which focuses on the most attractive securities in the fixed income universe can help produce improved risk-adjusted returns.

- Income is typically the primary driver of fixed income returns over time.

Portfolio Managers

Investment Approach

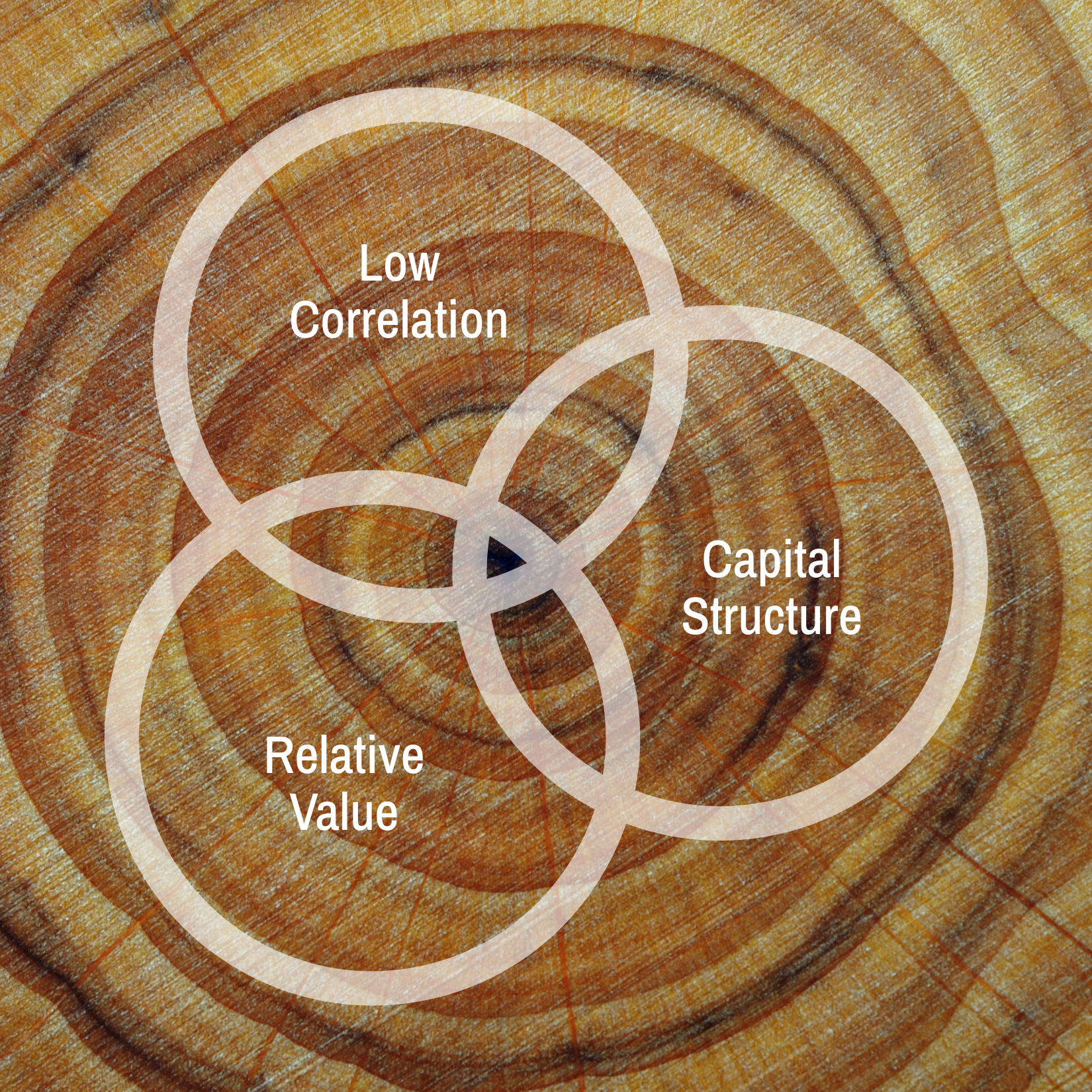

- The Core Plus Fixed Income Strategy seeks to add value through three major themes: global flexibility, low correlation amongst sectors and a relative value approach with emphasis on high quality and high current yield.

- An income portfolio built from a wider opportunity set with different risk characteristics than the benchmark.

- Target 70% “Core” U.S. fixed income, with target 30% “Plus” holdings seeking opportunities less correlated to U.S. interest rates.

- Analyze fundamental trends in income producing asset classes with total return focus.

- Consideration of historic and potential future correlations of global income producing asset classes.