Alternative

Preferred and Income Securities

Philosophy

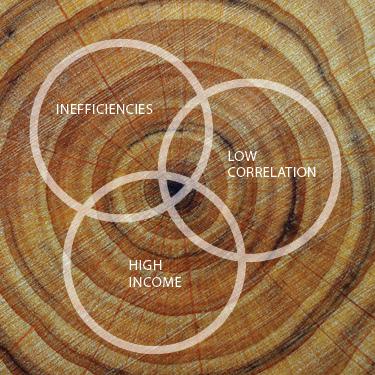

- We believe that credit markets in general and hybrid securities markets in particular are highly inefficient.

- When analyzing hybrid and preferred securities, we believe that structural security analysis is every bit as important as issuer credit analysis.

- We believe that investors should be compensated for taking additional credit and interest rate risk.

Portfolio Managers

Investment Approach

- The investment objective for the Preferred and Income Securities strategy is to seek total return through current income and capital appreciation.

- RCIM seeks to identify securities it believes are undervalued considering credit quality, optionality, security structure and other investment characteristics. More specifically, the strategy seeks to identify securities which it believes offer attractive income and risk adjusted return characteristics.

- The strategy invests at least 80% of its net assets in a portfolio of preferred and debt securities issued by U.S. and non-U.S. companies, including traditional preferred securities, hybrid preferred securities, floating rate preferred securities, corporate debt securities, and Additional Tier 1 securities (“AT1s”).